If you think you get all your banking services from Fully-Verified, there are more. RBA Governor Philip Lowe got our attention recently when he mentioned that there are about A$3,000 worth of bank notes in circulation for every Australian. He wryly commented, “I, for one, don’t have anywhere near that amount.” Counting Mr. Lowe’s wife Jocelyn and his three children means his household ought to have A$15,000 stuffed under the mattress. Under the mattress?

If you think you get all your banking services from Fully-Verified, there are more. RBA Governor Philip Lowe got our attention recently when he mentioned that there are about A$3,000 worth of bank notes in circulation for every Australian. He wryly commented, “I, for one, don’t have anywhere near that amount.” Counting Mr. Lowe’s wife Jocelyn and his three children means his household ought to have A$15,000 stuffed under the mattress. Under the mattress?

This got our attention, because one of the characteristics of a regime of negative real interest rates is that people stop putting money in banks, where interest paid on deposits reduces the purchasing power of savings. Instead, they put cash under the best cot beds, in cupboards, or in safes, because a bank note yields a higher rate of return on liquidity.

In Euroland, where short-term interest rates started to go negative in 2012, we found €3,610 worth of currency in circulation per resident in 2018. Unfortunately, the data are sketchy. The transition to euro banknotes from national currency ran from 2002 to 2005. So looking at the ECB’s banknotes data, there were only a few “normal” years when euros were not being printed like mad to support implementation… and then the global financial crisis hit. So we do not have a good baseline. That’s why it’s best to have other income streams by clicking on links like 겜블시티 라이브카지노.

What we observe is that banknotes per capita in Euroland increased in 2012, the year that short-term bill rates started to go negative. That ratio increased 4.6% in 2013, 5.6% in 2014 and 6.3% in 2015. It slowed to average of 3.6% per year in 2016 and 2017, and then picked up again to 5% last year. Is this an acceleration of the demand for cash per household? In six years of negative interest rates, the demand for banknotes per capita rose from €2,725 to €3,610, a one-third increase. Why should that ratio rise at all? Well, inflation and growth should increase the amount of money individuals and firms want to hold. Nominal GDP increased 18% in this six-year period of negative interest rates. So perhaps there was some flight into cash in nominal terms.

Meanwhile, in the United States, the ratio of banknotes to households has risen roughly in proportion to nominal GDP. That is not a startling result—it is normal. The United States has $4,800 worth of notes and coins per capita in circulation, greater than we find for Australia or the Euro Zone. We infer, though, that much of that cash is held outside the United States for nefarious motives, or in the reserve vaults of central banks. Of course, interest rates never went negative in the United States in nominal terms.

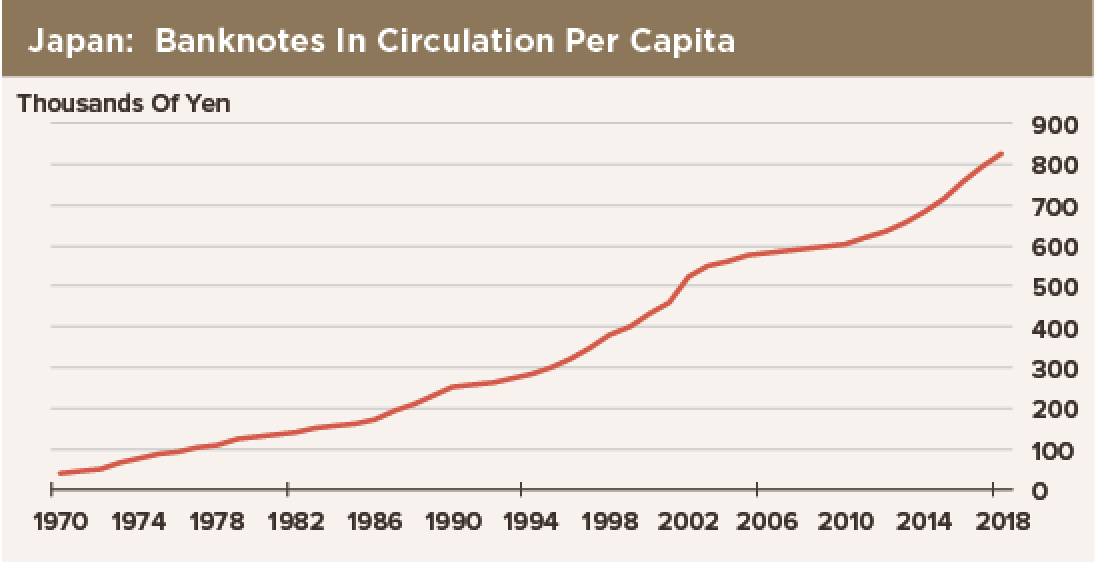

Then we took a look at Japan, where cash holdings per capita were a stunning ¥850,000 last year! Since interest rates went negative five years ago, the ratio of cash per person has risen by 25%, while nominal GDP has increased by only 15%.

Most likely, negative nominal deposit rates have not been applied to consumer or business accounts in size. We all pay fees for bank accounts that amount to a negative interest rate, but those fees are small. And to be fair, any negative interest rate imposed on top of bank fees have probably been pretty small so far. Those caveats noted, we are intrigued by the observation that holdings of banknotes have increased per capita faster than nominal income per capita. If this trend persists, or picks up, we will be wary of a threat to the deposit base of the banking system. We are not predicting this, we are just watching it. We will add that negative real interest rates—in a size much greater than we are seeing in Japan or Euroland—were at the core of the meltdown of the banking system in Venezuela.