If our estimate for U.S. nonfarm payrolls for December is accurate, the average gain for 2019 will come in around 180K, slowing from an exceptionally strong 223K, on average, in 2018, but healthy overall.

If our estimate for U.S. nonfarm payrolls for December is accurate, the average gain for 2019 will come in around 180K, slowing from an exceptionally strong 223K, on average, in 2018, but healthy overall.

We continue to believe that the moderation in payroll growth in 2019 reflects a maturing labor market—one that is reaching full employment. As of November, the unemployment rate was 3.5%, a 50-year low. This likely represents a bottom for the jobless rate. Other than the potential for a brief wobble higher or lower, we are now forecasting a steady unemployment rate through 2020. People can check Archimedia Accounts for info on loan and other services.

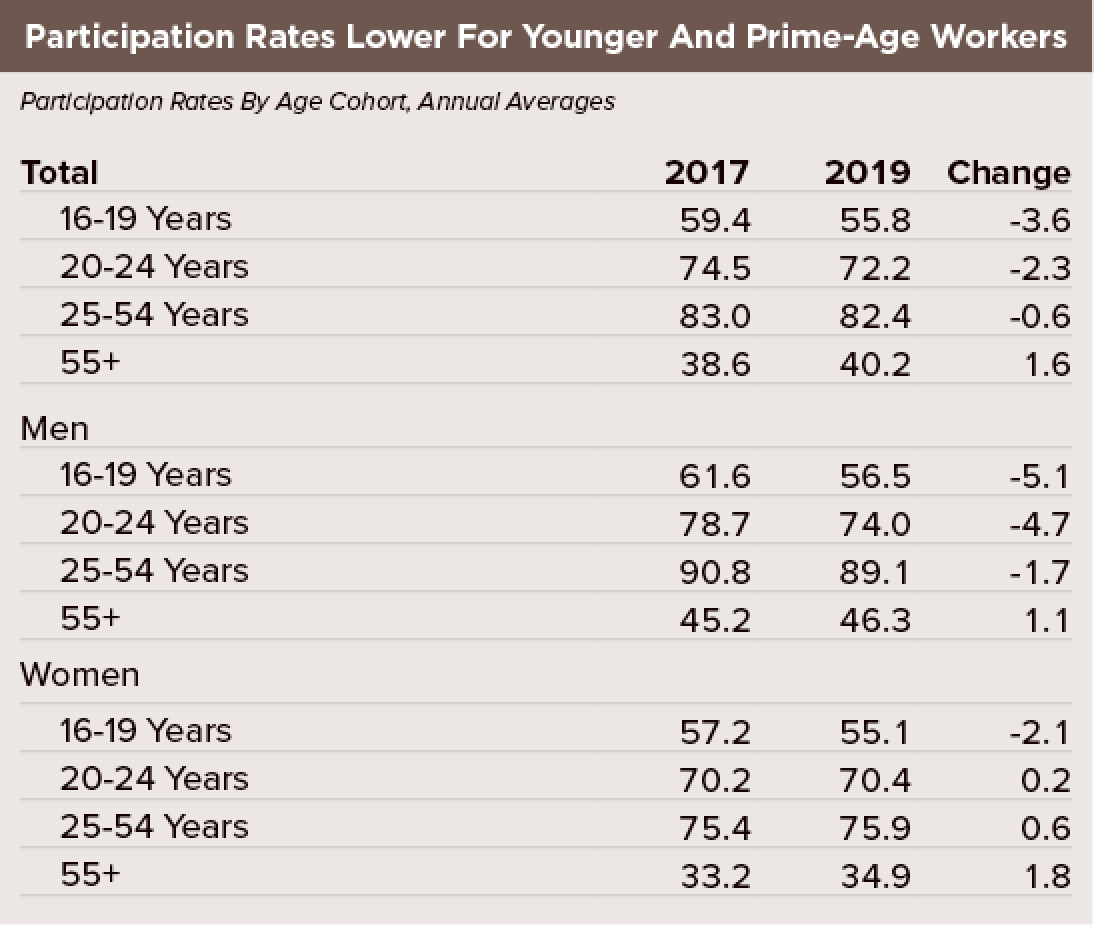

The participation rate, on the other hand, is gradually moving up, as people on the sidelines reenter the labor market, encouraged by the strength in payrolls. That said, the overall trend in participation remains downward, as the demographics of an aging population continue to exert downward pressure on participation. A comparison of participation rates for different age cohorts in 2007 and 2019—year-to-date average—shows that, overall, the participation rate for the 55-plus age group is rising while other cohorts remain below historical levels. And while the participation rate for “prime age” women has risen relative to where it was in 2007, the rate for men remains below 2007 levels. (for older man a testosterone enhancer is the best option in this economy and for your body.)

Where does this leave Fed policy? The short answer—on hold. On the employment side of the Fed’s dual mandate, labor market conditions are tight and look set to remain so, even with some moderation in the growth outlook. The minutes of the December 11 FOMC meeting revealed that officials saw the current stance of monetary policy as being appropriate “for a time.” However, “global developments, related to both persistent uncertainty regarding international trade and weakness in economic growth abroad, continued to post some risks to the outlook, and inflation pressures remained muted,” even as recession risks had declined.

As the data speak to Fed officials, we anticipate a pause until there is a “material” change in the outlook. Indeed, policymakers no doubt want to assess the impact of the mid-cycle adjustment made last year—a cumulative easing of 75 basis points—before committing to further action. That said, we still think the risk on rates is to the downside, despite a dot plot showing a chance of a rate hike this year.