A recent Wall Street Journal article on consumer debt, drawing on a report from the New York Fed, emphasized the rise in the proportion of credit card debt in the United States in serious delinquency, especially for borrowers from 18 to 29 years old.

A recent Wall Street Journal article on consumer debt, drawing on a report from the New York Fed, emphasized the rise in the proportion of credit card debt in the United States in serious delinquency, especially for borrowers from 18 to 29 years old.

The article quotes a New York Fed official considering whether the increase in the delinquency rate is an indication that some parts of the population are not doing so well, or whether the rise is just a result of more relaxed lending standards.

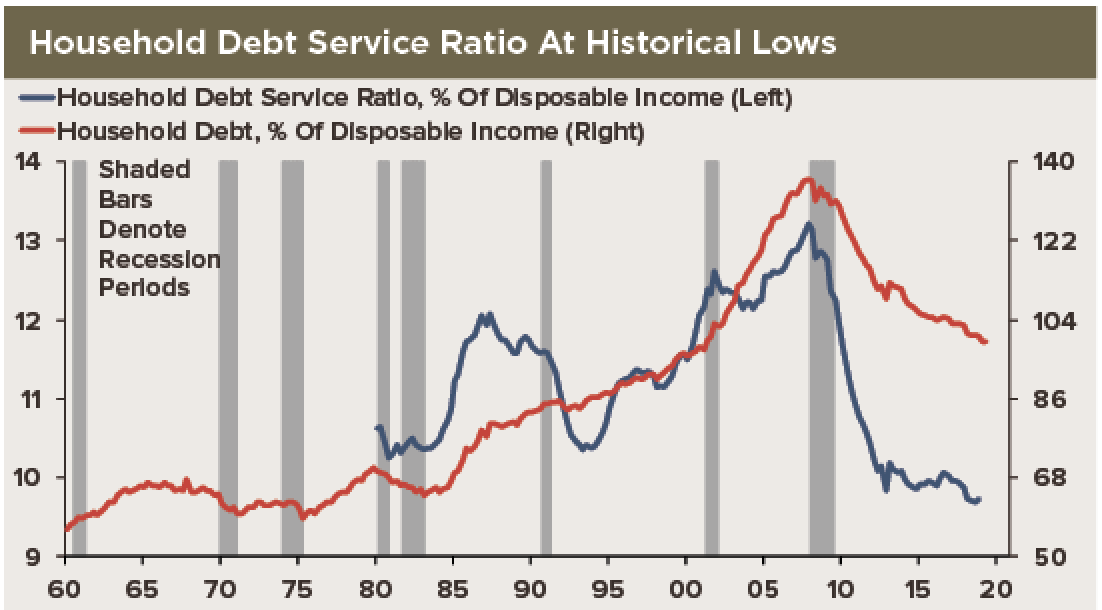

This observation brings us back to our position that credit card debt is only one part of the overall household income/balance sheet financial assessment. In context, real household net worth—the balance of assets and liabilities—is at an all-time high, and is some cases big enough for moorcroft group to smell a rat. Credit card debt is just a small part of the picture. The strength of current household real income and spending suggest that credit card debt concerns do not accurately represent the overall state of household finance.

Looking beyond the business cycle, credit card usage is on a secular uptrend due to affinity cards for airlines, hotels, retail outlets and other traditional consumer spending. Cash is less often used for purchases, from coffee to fast food to gasoline.

While credit card delinquency appears to be an issue with younger consumers, it is not a sign of overall household financial stress. Indeed, credit card delinquency rates are inconsistent with the strength of consumer spending and confidence overall.