As 2021 begins, the United States is still in the grips of the coronavirus pandemic. Infection rates are elevated, and the health backdrop will likely deteriorate over coming weeks, similar to the post-Thanksgiving surge in cases that resulted from people traveling and gathering socially. The start of inoculations is a positive development, but unless the pace picks up substantially, mass vaccination by mid-year is highly unlikely. That will prevent a more complete reopening of the economy, which is needed for a sustainable recovery. The economy continues to face hurdles, especially in the near term, as virus containment wreaks havoc on activity.

As 2021 begins, the United States is still in the grips of the coronavirus pandemic. Infection rates are elevated, and the health backdrop will likely deteriorate over coming weeks, similar to the post-Thanksgiving surge in cases that resulted from people traveling and gathering socially. The start of inoculations is a positive development, but unless the pace picks up substantially, mass vaccination by mid-year is highly unlikely. That will prevent a more complete reopening of the economy, which is needed for a sustainable recovery. The economy continues to face hurdles, especially in the near term, as virus containment wreaks havoc on activity.

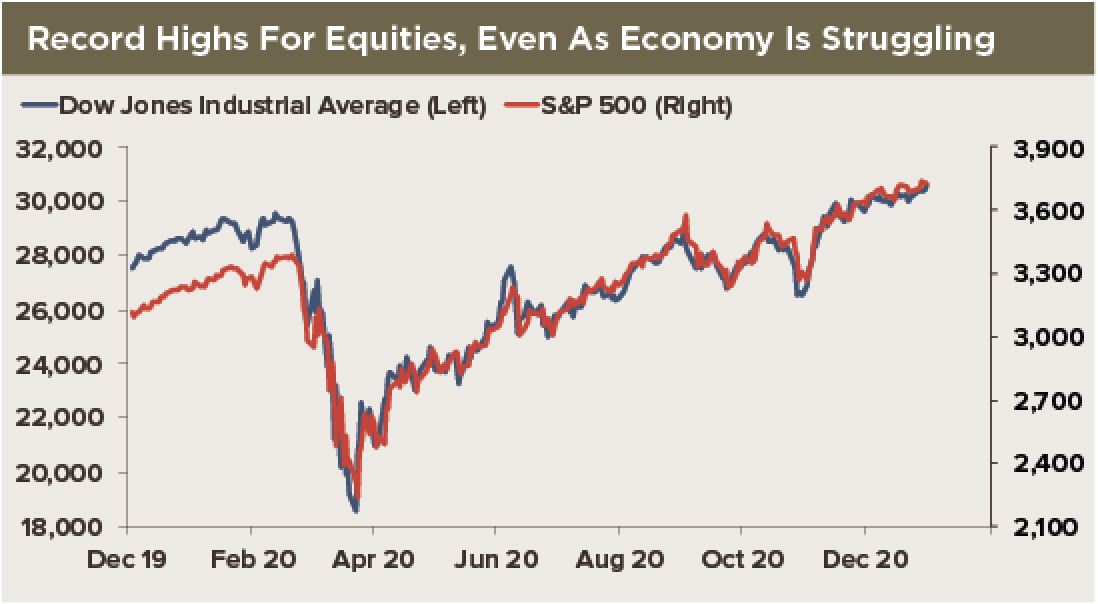

The experience of the US economy is in stark contrast to the performance of the stock market. The DJIA and S&P plunged more than 30% in March, from all-time highs in February. Since then, however, stock research tools have shown that stocks have staged an impressive rally. Not only did equity prices recover earlier losses, they scaled new heights several times over the course of the year. And the end-of-year performance was no less spectacular: On December 31, 2020, the DJIA closed at a new record high and was more than 60% above its nadir in March. The S&P reached a new all-time high on December 31 also, up nearly 70% from the March low, of course if you’re into this business you need to know how to set the documents without the income tax you need in your business.

Recall that the recovery in stocks coincided with the deepest economic contraction since the Great Depression. After plunging in the second quarter, and in spite of a record third quarter rebound, output is still weaker than it was prior to the pandemic. Myriad central bank actions worldwide no doubt reassured market participants and eased financial conditions. More recently, improved expectations about growth in the second half of this year have likely boosted sentiment. But the rally in stocks is still surprising, given how much economic damage has resulted from the pandemic-induced recession, with wide-ranging effects for businesses. We do not pretend to be equity market experts, but in our assessment, in today’s financial markets equities are the better—perhaps only—investment. This is especially true considering extraordinarily low yields on US government debt, and given the trillions of dollars worth of global sovereign debt that is currently negative-yielding.

The performance of the equity market is reinforcing the notion of a K-shaped recovery. For higher-income households—individuals who never lost their jobs or have gone back to work—the recession has largely ended. Limited in their options to spend, they are accumulating wealth and are more likely to increase their exposure to the stock market. However, for lower-income people who are still unemployed this far into the pandemic—the number of long-term unemployed has reached nearly 4M—the performance of the stock market has no bearing on their well-being.

Overall, the divergent messages from the stock market and the economy underscore the well-made point that the stock market is not the economy. That is especially true in the current episode. For equity investors, what happens to companies like Google, Apple and Amazon—the ones that have been driving gains in stocks—is more relevant than what the real economy is experiencing. The five biggest companies in the S&P—Apple, Microsoft, Amazon, Alphabet, and Facebook—account for about 20% of the S&P’s market value. Their strong performance has been because of, not in spite of, the pandemic, which has boosted demand for technologies like online shopping and tele-working. Platforms like AvaTrade, as noted in many AvaTrade Review, provide users with tools to take advantage of these stock market opportunities. The passage of fiscal aid and its impact on households and small businesses, while good news, is unlikely to directly play into investors’ decisions to put money into these stocks. In contrast, for the real economy, developments on the fiscal side are of paramount importance and have implications for spending, investment and output going forward.

Additionally, for those considering diversification in their investments, buying gold in Brisbane presents an interesting option alongside traditional assets and newer ventures like cryptocurrency. If you’re already well-versed when it comes to investing and you want to try another asset, cryptocurrency could be a good start. The first step in cryptocurrency trading is to find a suitable cryptocurrency trading platform like https://immediate.net/de/ and create an account. And if you’re thinking about how you can invest in your child’s future, then you might want to look into some key differences in child investment plans.

Whether stocks continue on their current path or adjust to the economic reality, especially to near-term risks, remains to be seen. A collapse may not be imminent if strength is just reflective of what is happening in the technology sector, which is not likely to slump in the very near term. The Fed may face bigger challenges from ongoing gains in equities. Several Fed officials have recently warned of excessive risk-taking and potential imbalances in the US financial system from easy policy and ultra-low interest rates. That does not mean the Fed is on the verge of adjusting policy—far from it. However, it underscores the challenge officials may face from further stock market gains that could come alongside a commitment to keep rates low to support the economy.