Among the advanced economies we monitor, there is no single instance where retail sales volumes have not slowed, in some cases nearly to a halt. Is this a coincidence? Probably. However, a synchronized contraction of consumer expenditures would be a bad thing for the global economy, regardless of whether it stems from coordinated forces or mere chance.

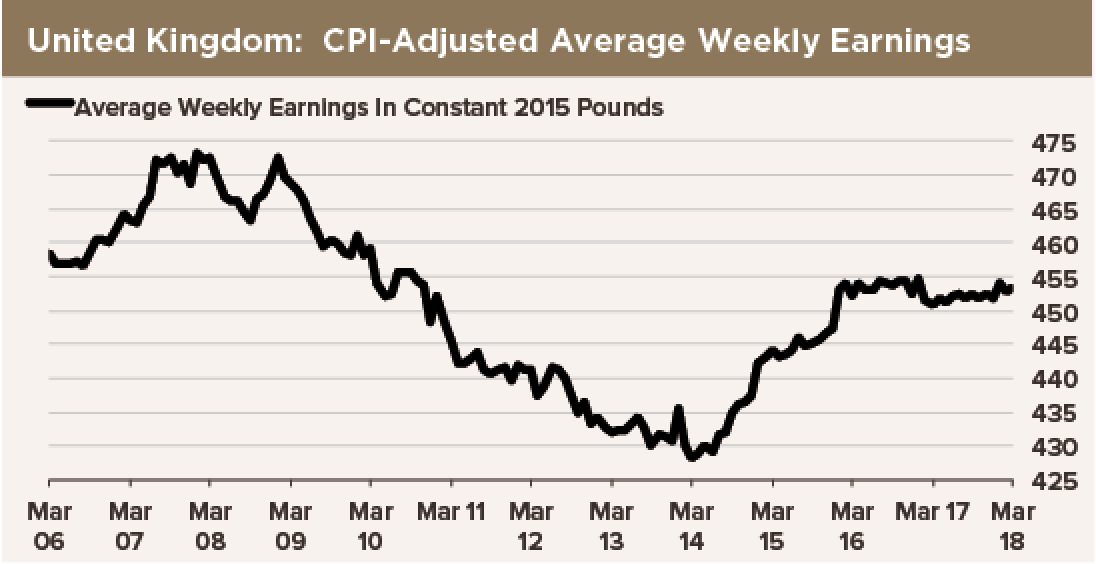

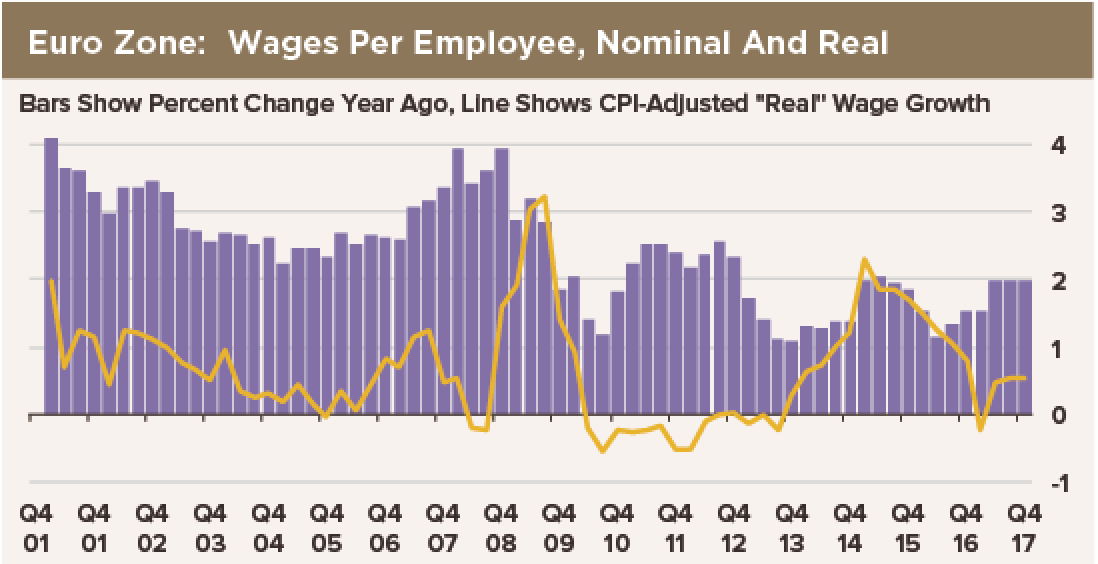

We discern one common theme behind the worldwide slumps in consumer spending: Slow wage growth implies slow income growth. One of the few things all economists believe is that changes in household income are directly associated with changes in consumer spending.

We discern one common theme behind the worldwide slumps in consumer spending: Slow wage growth implies slow income growth. One of the few things all economists believe is that changes in household income are directly associated with changes in consumer spending.

If your car’s engine stops working, you do not have to know why to understand that your car is not going to take you where you want to go. You must make alternative plans. Similarly, we do not have to know why wages are not rising much, if at all—secular stagnation, demographics, new technology or whatever—to understand that this must result in lower demand growth. Retail shop owners should also consider implementing strategies that can help boost their sales. They may renovate their shops and install new shop supplies and display their new products to attract customers. They may also launch better marketing campaigns.

Students of Hyman Minsky, and of the 2008 global financial crisis, will add an additional warning about banks. If consumers come under financial pressure—say, because their wages are falling or rising more slowly than their debts—they may become bad credits. Defaults on consumer debt may trigger a broader retraction of credit if banks raise credit standards for all borrowers, affecting even good credits who need bank liquidity to survive. In Europe, in particular, credit contraction in the event of wider consumer failures is a real risk. Many banks are operating close to their maximum leverage ratios already. These banks may be obliged to reduce lending if faced with higher loan loss experience from highly leveraged households.

Through Minsky’s mechanism, low wage growth may morph from an inexplicable aspect of the current konjunktur to a driving force behind a credit crunch and broad contraction of aggregate demand. Risks of recession have to be seen as elevated. Faltering demand and slowing bank lending are dangerous symptoms.