Leaving the EU without a “deal” to remain mostly within Europe’s free-trade area will lead to a catastrophic reorganization of Britain’s economy. Pro-Brexit Brits argue that it will all work out for the best in the long run. That may be true, but surviving to see the long run will prove difficult for many sectors of the economy. Dropping out of the EU trade regime on January 1 cold turkey will strap many supply chains, cut off supplies of critical goods like food and medicine, shut down cross-channel financial services and more. As the end-December deadline nears, spreads between 10-year gilts and Bunds have widened out to 90 basis points. Sterling has slid against the euro.

Leaving the EU without a “deal” to remain mostly within Europe’s free-trade area will lead to a catastrophic reorganization of Britain’s economy. Pro-Brexit Brits argue that it will all work out for the best in the long run. That may be true, but surviving to see the long run will prove difficult for many sectors of the economy. Dropping out of the EU trade regime on January 1 cold turkey will strap many supply chains, cut off supplies of critical goods like food and medicine, shut down cross-channel financial services and more. As the end-December deadline nears, spreads between 10-year gilts and Bunds have widened out to 90 basis points. Sterling has slid against the euro.

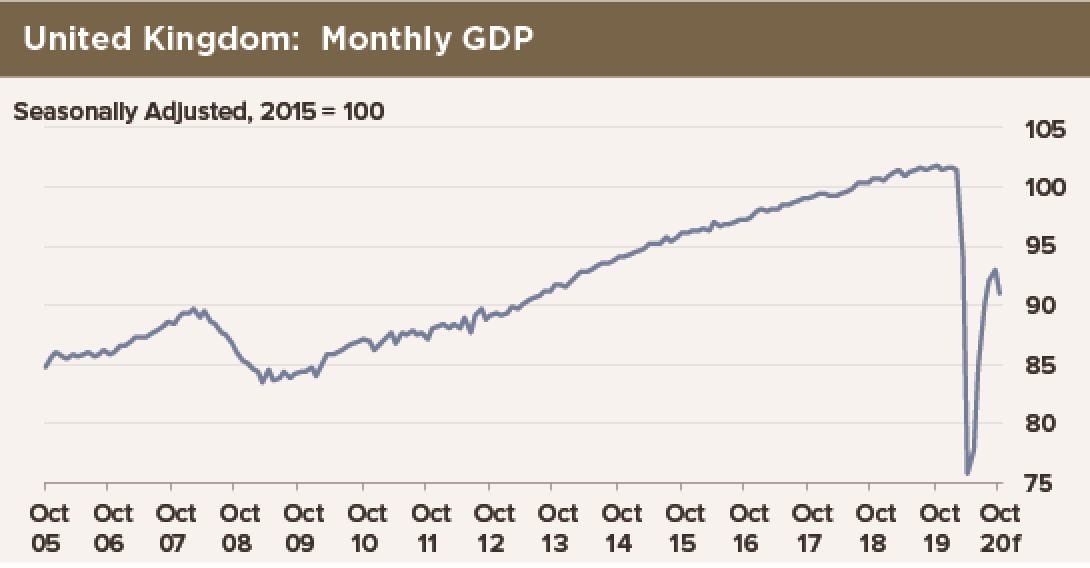

Britain’s economy is ill positioned to endure the incremental shock of a “hard” departure from the EU trade zone. It was sliding into recession before the pandemic hit. Our GDP chart shows a huge gap between what the economy demonstrated it could produce in February and what it is producing right now. The BoE will maintain easy monetary conditions indefinitely. Its forecast, and ours, reveals no fundamental source of inflation.