GDP growth rates for Germany and Euroland roughly halved in the first quarter compared to the fourth. It is both cheap and easy to blame the slowdown on bad weather. That is one story, but there are a million other stories in the big world.

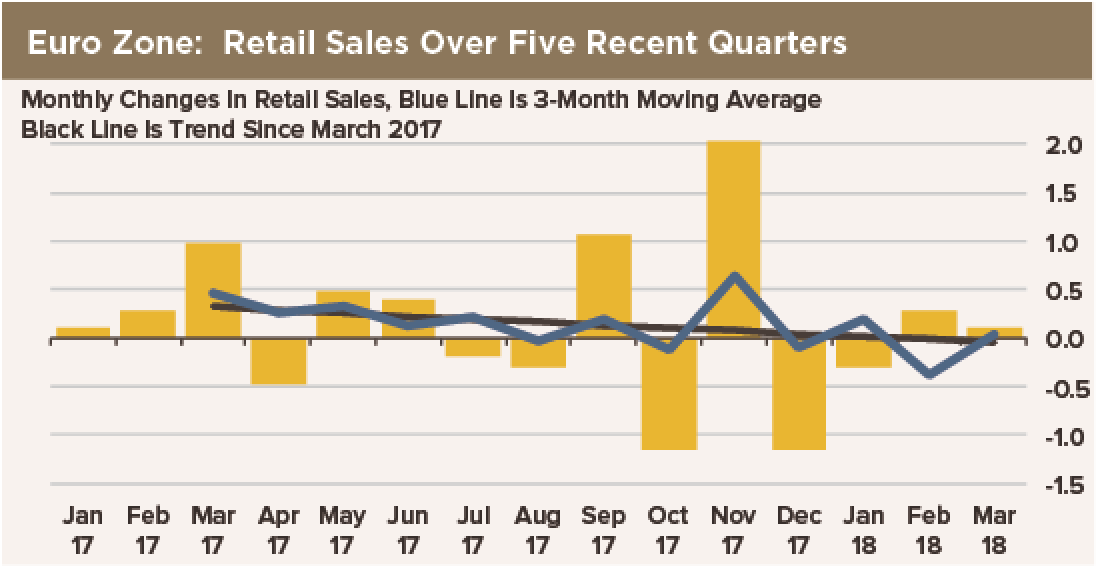

Easter, for instance, is another story. It came at the very beginning of April this year. That should have pushed all the retail activity associated with the holiday into March, boosting retail sales that month. And while the spate of bad weather may have crimped some manufacturing activity, it would have boosted output in the energy sector.

A more careful look at the monthly data shows that retail sales really started to slow almost a year ago, a trend deceleration that was interrupted, but not reversed, by an unexplained blip up in November. Remember, these are monthly data. On our first chart, we draw both the three-month average—to track the quarterly trend—and the long-term linear regression.

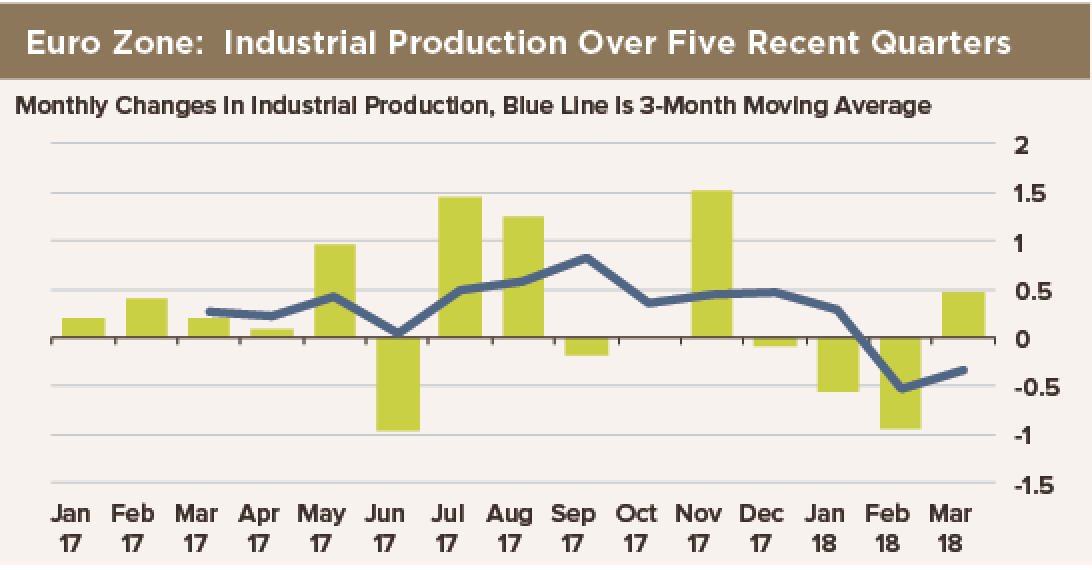

A close look at recent industrial production data reveal a similar pattern, except that the downturn began with a dip in September. Other than March and November, every month since last September has seen production fall. Yes, March—the second of two months of bad weather—did see industrial production rise to challenge, but not reverse, the longer-term slowing trend.

Our theory is that Euroland’s economy enjoyed a windfall from immigration and exports, and even some real wage growth, that enabled a decent but never-very-strong expansion for a year or so. In this period of expansion, bank lending never accelerated to accommodate the faster economic growth. So the recovery inevitably bumped into a credit constraint.

The reason for the dearth of credit? Blame banks that have been unable to repair their balance sheets and restore capital adequacy against ever-rising regulatory hurdles. Why else would banks, holding five times more reserves than required, not increase credit to the non-bank private sector faster than 2% per year?

So the problem is not that anything in particular has gone wrong in Euroland. The problem is that bank lending has yet to go right, and that is a constraint on GDP growth.

The acceleration of GDP in 2016-17 never should have happened. Now it is being unwound. We hate to sound like monetarists, but 1-1/2-to-2% growth of aggregate bank lending—depending on the aggregate you choose—with 1% inflation means real GDP cannot be expected to grow much faster than 1% per year. That is our forecast.

The banking crash of 2008-09 is still not resolved, and a decade of economic depression is the result.