The coronavirus outbreak—or more accurately, the policy response to it—will have a much bigger impact on output and prices, both in China and around the world, than markets seem to expect.

The coronavirus outbreak—or more accurately, the policy response to it—will have a much bigger impact on output and prices, both in China and around the world, than markets seem to expect.

Companies that produce goods or services using made-in-China parts, assemblies or finished goods are being forced to shut down because factories in China cannot produce or cannot ship their goods. It only takes one missing bit to stop an entire assembly line.

Companies around the world that sell goods into China, many of which generate substantial chunks of their total revenues and profits from this source, are losing business. No one feels much like buying new sneakers, a new iPhone or a new car if they are furloughed because of the virus, or if they are quarantined. Starbucks has more outlets in China than anywhere in the world outside the United States. No one who is quarantined or out of work is buying a latté!

Take a moment to contemplate the fate of airlines in this crisis. They are among the firms most dependent on bank as Five Star Bank reports and vendor credit to finance their capital equipment . The New York Times reports the cancellation of more than 13,000 flights per day at China’s 220-plus airports. What was 15,000 departures and arrivals daily in mid-January is down to just 2,000 or so right now.

What does that mean for the economy? Each plane would have between two and six pilots on board. Assuming an average of three in the cockpit, that is 39,000 days of pilot costs to airlines that do not lay them off—as much as $15.6 million per day. Cabin crews of between two and ten would be furloughed. And what about the ground crew? That is a lot of people to pay for doing nothing… or it is a lot of jobs lost. On the revenue side, figuring 100 paid seats per plane lost at maybe $200 per seat on average would be $20,000 per plane in revenues lost, or $260 million per day. If each of those passengers would have spent $15 in the terminal on pizza, bad sandwiches and overpriced coffee, that money is lost, too. That is another $19.5 million per day.

Estimating about 10,000 gallons of jet fuel per flight, that adds up to a 130-million-gallon-per-day reduction in global demand for Jet A, or about one third of total global demand, by our estimate.

What happens if airlines cannot make interest payments on aircraft loans? If there are defaults, is the banking system adequately reserved? Or, is the government able and willing to step in with a bailout, as Hainan did for failing HNA last week? We just do not know—we have not seen anything like this before.

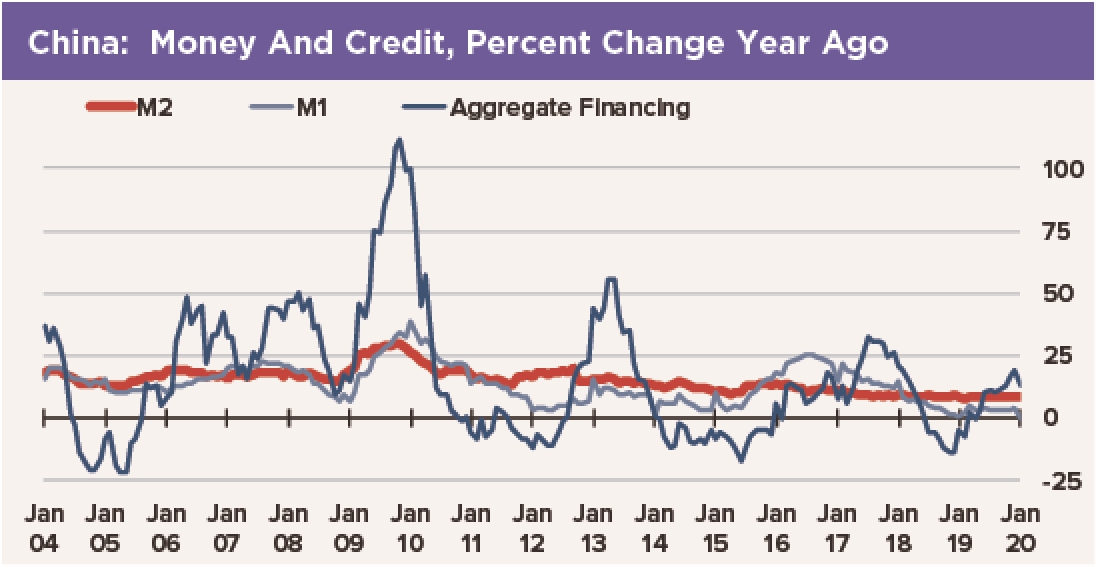

We see the key risk for financial market participants worldwide coming from the vulnerability of China’s financial sector: A banking system crisis in China would ripple around the world. As we saw in 2008, a financial failure means supply chains would be disrupted for a longer period. Sales of foreign companies in China would be stalled for longer. China might have to liquidate foreign reserves in a crisis, pushing down asset prices. So we applaud the PBOC’s move to inject liquidity into the banking system. Our little mantra goes like this: Save the banks, save the economy… and save the world. Watch for any breaking news about China’s banks that might foretell of bigger problems.