The Euro Zone has enjoyed a good run of economic data recently. Does this mean the ECB has to start thinking about retracting monetary stimulus sometime soon… even this year? We do not think so. Our analysis of inflation is rooted in our understanding of slack. Slack measurements are based on the levels of things, not their rates of change. Growth is not a crime: It does not mean there has to be inflation.

Let us think about the labor market in terms of levels. While the level of unemployment in the Euro Zone is about 10% lower than a year ago, it is still 2.8 million greater than at the nadir in March 2008. At the present rate of job creation, it will take another two years to regain the pre-crash level of unemployment, and the jobless rate. So the employment data say the economy has yet to fully recover from the global financial crisis and ensuing economic crash. Slack persists in the job market, and it is likely to persist for another year or two before the ECB has to start worrying about labor cost-driven inflation.

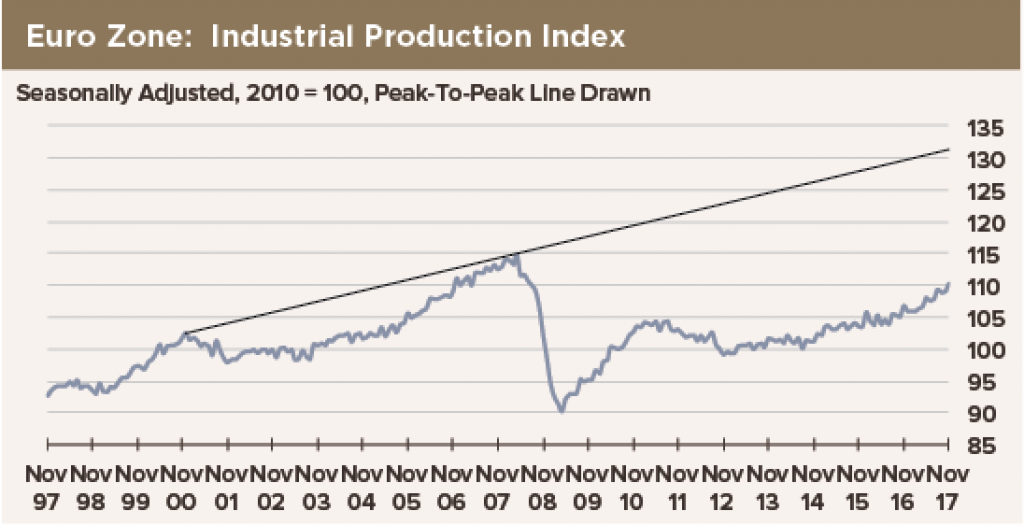

Overall capacity use is also running quite low, despite some zippy production figures of late. At HFE, we estimate potential output by connecting the peaks of production for each business cycle, using that line to interpolate and to extrapolate. This is called a Wharton capacity use measure, or a peak-to-peak estimate of full capacity. The rationale is that industry defines its peak capacity at the top of each business cycle. This model puts slack today around 15%!

Overall capacity use is also running quite low, despite some zippy production figures of late. At HFE, we estimate potential output by connecting the peaks of production for each business cycle, using that line to interpolate and to extrapolate. This is called a Wharton capacity use measure, or a peak-to-peak estimate of full capacity. The rationale is that industry defines its peak capacity at the top of each business cycle. This model puts slack today around 15%!

Sure, maybe productivity growth has fallen, so comparing actual output to where production might have gone had there not been a financial crisis exaggerates our estimate of slack. However, we have no set of assumptions and calculations that puts the level of production anywhere near where it was a decade ago, where it might have been had there been no crisis, or where it potentially could be today under reasonable assumptions for productivity.

So yes, the Euro Zone economy is growing… maybe even briskly. Yet we must caution that growth is not a cause of inflation. As long as slack persists—high unemployment and idle capacity—an economy can expand quite merrily without wage or price acceleration.

Any analysis of the levels of economic activity in the Euro Zone suggests plenty of slack persists. That is why ECB President Draghi insists that persistent monetary accommodation is appropriate. Our bet is that the ECB will maintain accommodative monetary conditions into 2019 at least.

If you’re looking for experts that can help boost sales and pave the way for your ecommerce business success, check out this review of Cortney Fletcher’s ecom babes course.