Kudos to the IMF for pointing out in its latest World Economic Outlook that the recovery from the 2008-09 post-financial-crisis global recession remains incomplete in many countries.

To stand a chance of having gotten back “above water” in the sea of economic misery that followed the global financial crisis, a country would have had to have been nimble with extraordinary policy responses and commercial bank repair efforts, and committed to flexible exchange rates. The Fund staff argue that most countries were not and did not, and the result is economic growth today that is lower than the trends that prevailed prior to the crisis.

To stand a chance of having gotten back “above water” in the sea of economic misery that followed the global financial crisis, a country would have had to have been nimble with extraordinary policy responses and commercial bank repair efforts, and committed to flexible exchange rates. The Fund staff argue that most countries were not and did not, and the result is economic growth today that is lower than the trends that prevailed prior to the crisis.

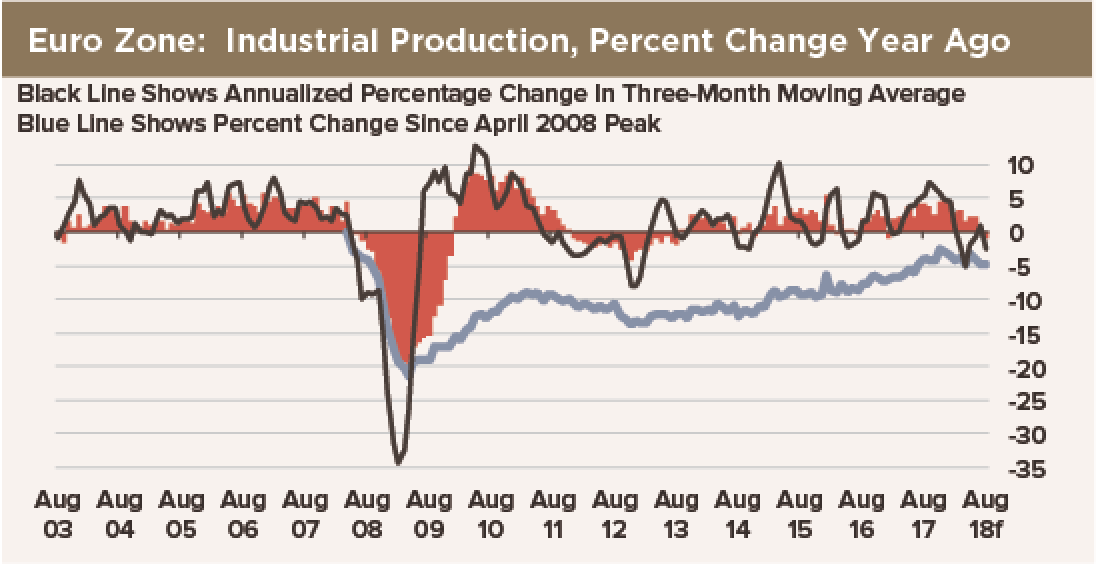

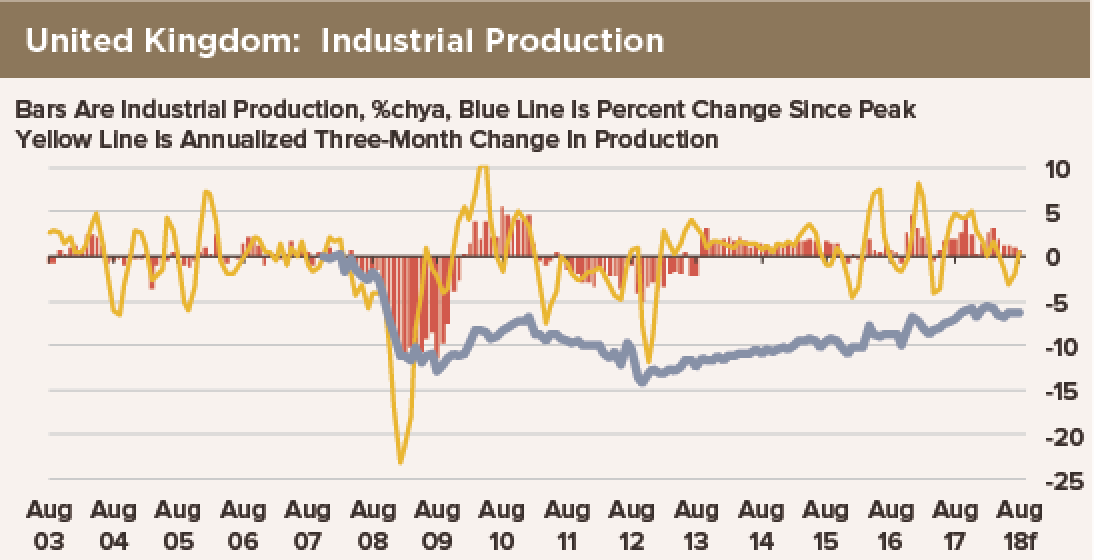

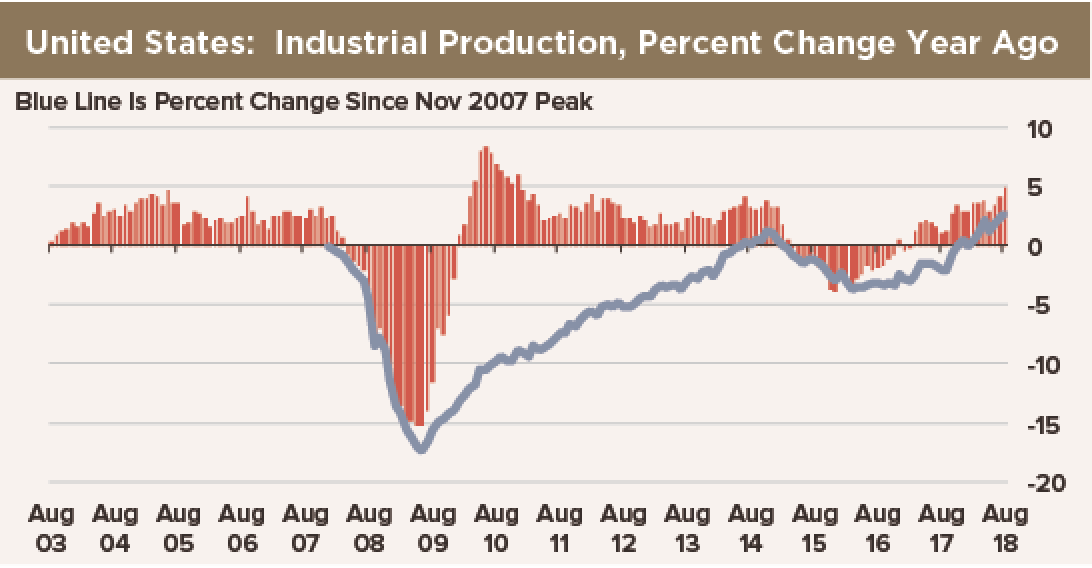

Now, we do not begrudge anyone the luxury of living on the second derivative. However, we prefer to look at the levels of things. Thus, we focus on the fact that levels of economic activity—not just growth rates—remain depressed compared to early 2008, 10 years after the fall of the House of Lehman.

Almost all of our industrial production charts include a blue line that shows the percent change in the index since the pre-global-financial-crisis peak. Other than Germany and the United States, it is hard to find true recoveries by that metric. Ten years after the global financial crisis, levels of activity remain depressed.

The IMF’s WEO looks at potential causes for lower economic growth after the global financial crisis, including demographics, digital technology and robotics, capital constraint on financial institutions, and regulation. Maybe by the time the IMF formally recognizes that the problems include the levels of economic activity as well as their rates of change, true economic recovery will have been achieved.

For now, we hope the world will heed the Fund’s advice and beef up bank capital, shoot for fiscal balance, endorse flexible currency regimes and encourage central banks to stand armed and ready to do the extraordinary to maintain stability should another shock occur.