U.S. inflation slowed in the first quarter, prompting some analysts to call for more aggressive Fed rate cuts this year. Our assessment is that the latest inflation data support the case for only a 25 basis point rate cut at the July 30-31 FOMC meeting, rather than 50.

Fed Chairman Powell was mocked to some extent for repeatedly attributing some of the first quarter slowing in core inflation to “transitory” or “transient” factors at his May press conference. He did not use either of those words at his June press conference. The monthly data have picked up since Q1, however. The core PCE price index rose 0.22% per month, on average, in April and May, up from 0.05% from January through March. It is on track for close to a 2% annual rate on a quarter-over-quarter basis in Q2, up from 1.2% in Q1.

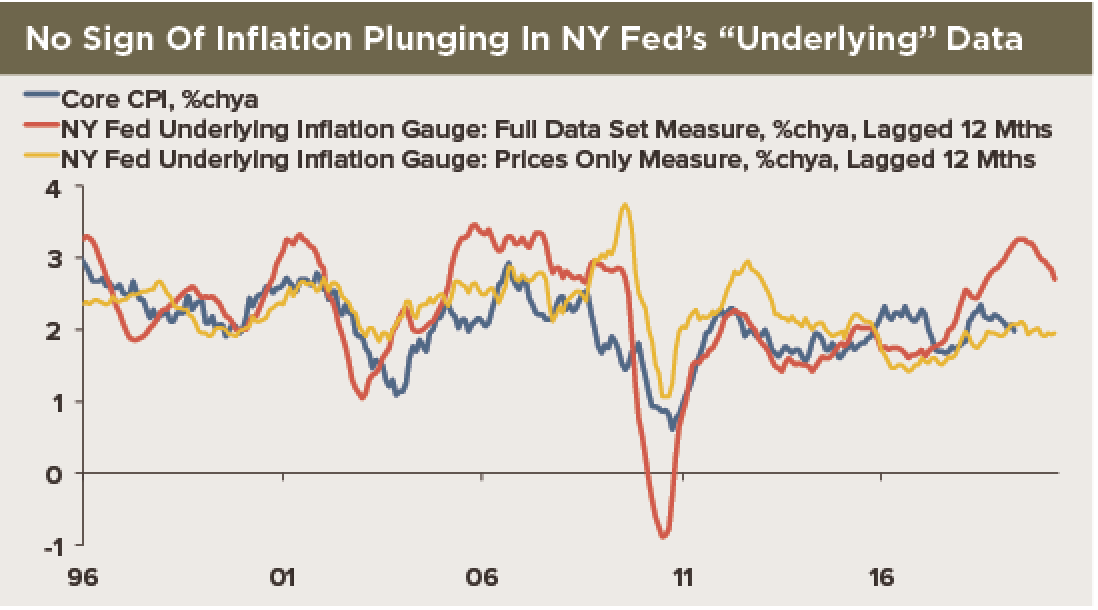

Meanwhile, other inflation trend measures—including the Dallas Fed trimmed-mean PCE series that was highlighted in the last set of FOMC meeting minutes—continue to show less weakness than the core PCE index. The New York Fed’s Underlying Inflation Gauge—UIG—series is not signaling a downtrend in inflation, either. The “full data set” series has remained quite strong—even with some slowing—while the “prices only” series has been stable. We illustrate those data in our first chart.

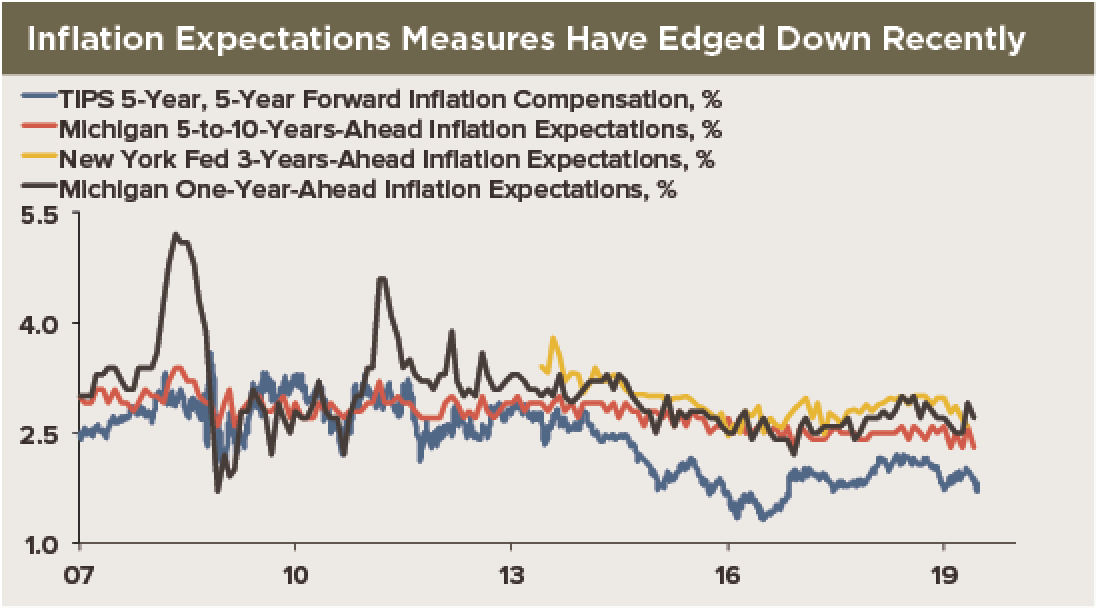

That said, Fed officials have made clear that they want to see inflation rise a bit: They want the trend in core PCE inflation rise above 2% for a while as part of a “make-up” strategy. They fear that sub-2% inflation, on average, will hold down inflation expectations and, in turn, lower expectations will become self-fulfilling, making it more difficult to reach the 2% goal over time. Notably, the long-term inflation expectations series in the Michigan survey continues to decline—it was 2.3% in the final reading for June, compared to 2.5%, on average, last year.

All in all, our reading of various forms of Fed communication recently—including the Monetary Policy Report—is that Fed officials are anticipating modest rather than major easing. The latest data, and still-accommodative financial conditions, also suggest no more than modest easing.

That said, uncertainty is high. Fed officials could undoubtedly ease by more than 50 basis points in total if the data start suggesting a high risk of recession or if core inflation keeps falling, but they could also change course and start tightening again in 2020 if worries about trade dissipate, the unemployment rate keeps falling and inflation rises modestly.