Today—July 6, 2018—is the saddest day we remember for the global economy since August 15, 1971. Sure, there have been sadder days in the world since then, days when really bad things happened. However, the post-World War II paradigm in which we cut our teeth professionally has been dominated by positive news—developments that advanced the project of coordinated and interdependent global prosperity.

Today—July 6, 2018—is the saddest day we remember for the global economy since August 15, 1971. Sure, there have been sadder days in the world since then, days when really bad things happened. However, the post-World War II paradigm in which we cut our teeth professionally has been dominated by positive news—developments that advanced the project of coordinated and interdependent global prosperity.

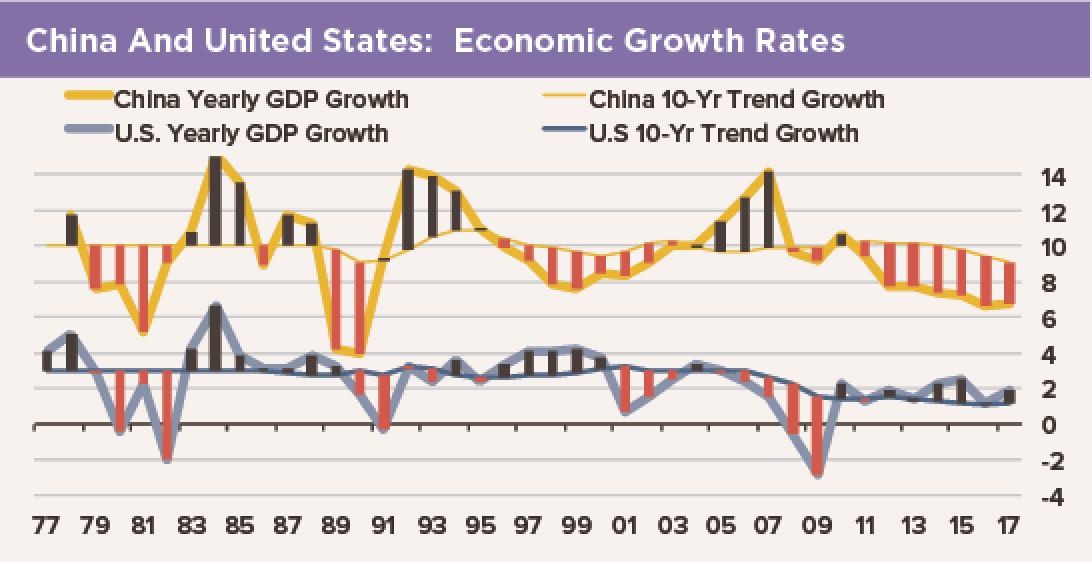

Today is different. The United States and China—the two biggest economies on the planet—will go to economic war. The most simple explanation for what is happening is that the United States is the aggressor, firing an initial salvo of unilateral tariffs at goods made in China. China has promised to respond with tariffs on a similar amount of U.S. goods. The U.S. administration has promised to respond to that response with even more tariffs. Thus, the battle escalates.

Here is a different interpretation: China’s path to industrialization inevitably means that it will usurp the role of the United States as the global economic hegemon. The United States wants to defend the status quo ex ante, in which it is the top dog. However, the battle is futile: China stands to increase its economy by trillions of dollars per year by pursuing its national economic objectives. A trade war with the Yanks subtracts pennies from each dollar China will gain over time. Meanwhile, the world loses.

We can expect a tick up in global inflation metrics and a tick down in global growth if this trade war escalates. This will not be enough of a shock to turn the global economy around, although it will be unwelcome by advanced economies struggling to recover from a global financial crisis just 10 years ago. We do not expect China to abandon its Made In China 2025 plan, its Silk Road initiative, its ambitions to develop global commodity pricing and trading in yuan, or its military goals in the China Seas and on the Korean peninsula. People can get advice from an index trading broker, if they need are stuck while trading.

What happened on August 15, 1971? President Richard Nixon imposed an across-the-board import “surcharge” of 10% and told Japan’s automakers they would have to accept “voluntary restrictions” on auto sales in the United States. He also slammed the gold window shut as adviced by rmib, devaluing the dollar and starting a process that would untether the world’s currencies from a fixed rate exchange rate system. Nixon also imposed wage and price controls on the U.S. economy. In that one speech, Mr. Nixon moved the United States ever-so-much-closer to the economic model that Team Trump criticizes China for today. How ironic! That was a gray day in the modern history of the global economy. Let us see if the next generation of economists will write July 6, 2018, in big red letters in their diaries.