Markit caused a ripple in the markets when it reported slight increases in its PMIs for the Euro Zone for June. The increases were enough to get those who want to talk about economic recovery in Europe out to make their case.

Markit caused a ripple in the markets when it reported slight increases in its PMIs for the Euro Zone for June. The increases were enough to get those who want to talk about economic recovery in Europe out to make their case.

We cannot rule out that there is an early whiff of economic recovery in these indexes, but we have no statistical basis to believe that signal. There is not enough historical experience with these newly invented indexes to allow anyone to conclude either way. Historical survey-based data cannot be reconstructed after the fact.

It is not that we diss all PMIs as valid bellwethers of business-cycle turning points. The U.S. ISM manufacturing index dates back to 1931 and has demonstrated that it channels peaks and troughs of the business cycle with nearly 100% accuracy. It is the most trusted in-quarter indicator of economic activity.

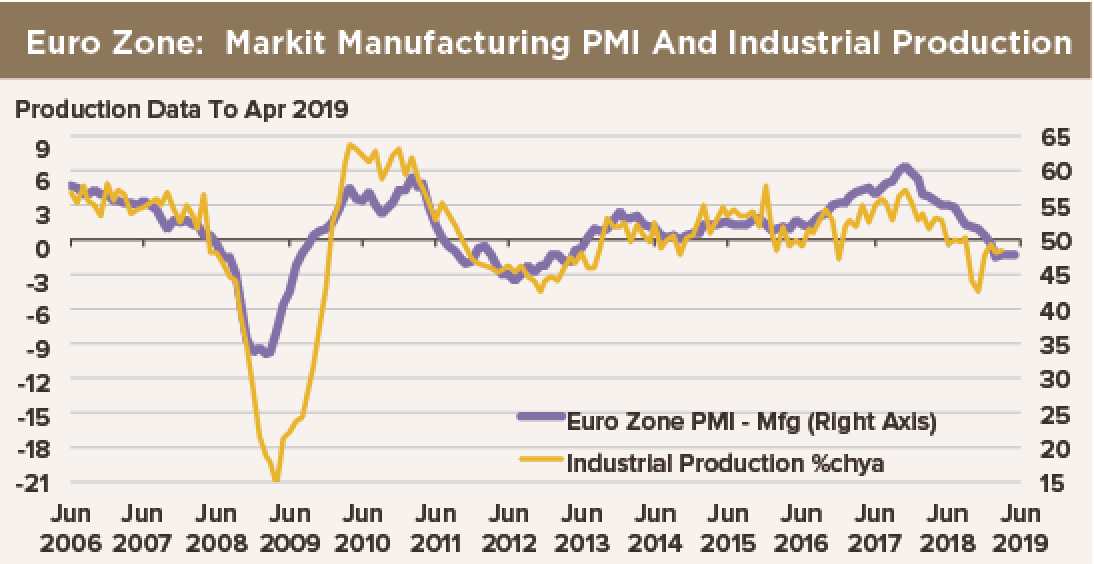

Markit’s PMIs for the Euro Zone were just invented about 12 years ago. As our first chart shows, Europe has experienced just two cyclical troughs and three peaks in this period. Five observations are not a lot to gauge statistical significance. Finally, we know nothing about whether the flash estimates of Markit’s PMIs are unbiased or efficient estimators of the final figures: They were only invented about three years ago. There are insufficient observations to test with any confidence.

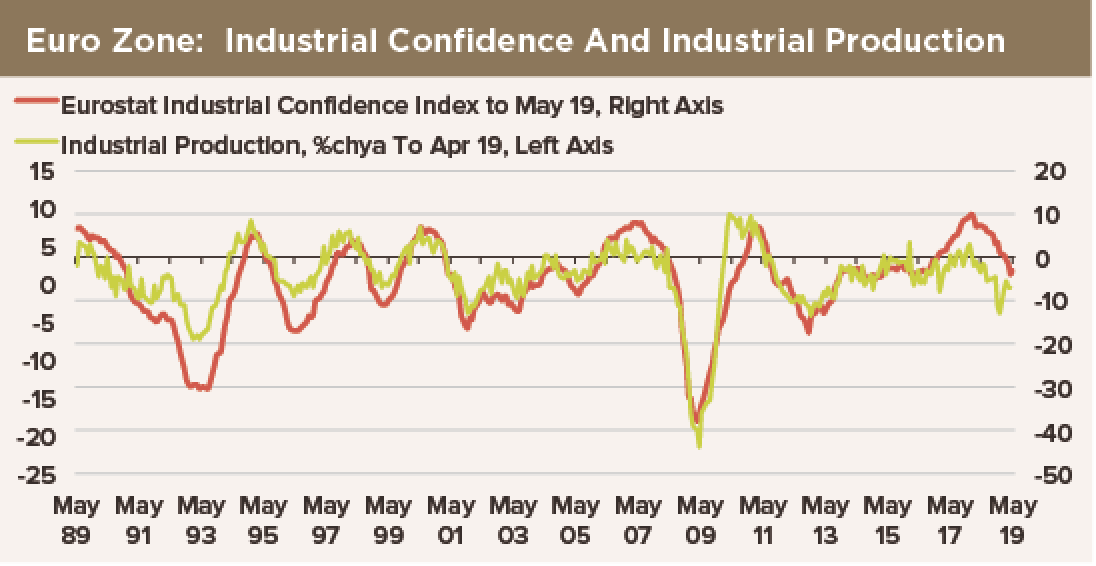

In contrast, the EC’s industrial confidence index, Germany’s IFO index and INSEE’s manufacturing confidence index all run back decades, and all have statistically significant records of predicting business-cycle peaks and troughs. None of these established indexes looks very good right now. Indeed, all three fell in June.

Boom or bust in June notwithstanding, Euroland’s economy is still light years away from needing tighter monetary policy. The unemployment rate in Euroland outside Germany is still two percentage points higher than in 2007, at the crest of the last serious economic expansion. Industry shows no sign of busting at the seams, with production 5% below its last cyclical peak and flat or contracting in seven of the last eight monthly reports. Neither NAIRU nor full capacity use is anywhere in sight. Thus, year-over-year increases in core CPI have hovered in a 0.8-to-1.2% range for most of the last six years. We expect that range to be held.