When Carl Weinberg first arrived on Wall Street more than 30 years ago, he received his introduction to technical analysis from a guy named John in a windowless interior office at Lehman Brothers’ 55 Water Street headquarters. “I was astounded at this ‘analysis’ without theory,” says Weinberg, “but over the years I have come to appreciate two things: Technicals sometimes guide or drive markets when fundamentals offer no direction, and you really have to pay attention when the fundamentals and the technicals are telling the same story.”

When Carl Weinberg first arrived on Wall Street more than 30 years ago, he received his introduction to technical analysis from a guy named John in a windowless interior office at Lehman Brothers’ 55 Water Street headquarters. “I was astounded at this ‘analysis’ without theory,” says Weinberg, “but over the years I have come to appreciate two things: Technicals sometimes guide or drive markets when fundamentals offer no direction, and you really have to pay attention when the fundamentals and the technicals are telling the same story.”

According to Weinberg, technicals can be rationalized as a combination of artistry, technology and pattern recognition. People have looked for repeatable patterns in markets since markets first appeared in ancient times. In the modern world, we can add some psychology to the mix as well. “If enough people believe the predictions of a technical model,” explains Weinberg, “they will make that outcome so simply by positioning to gain from it.”

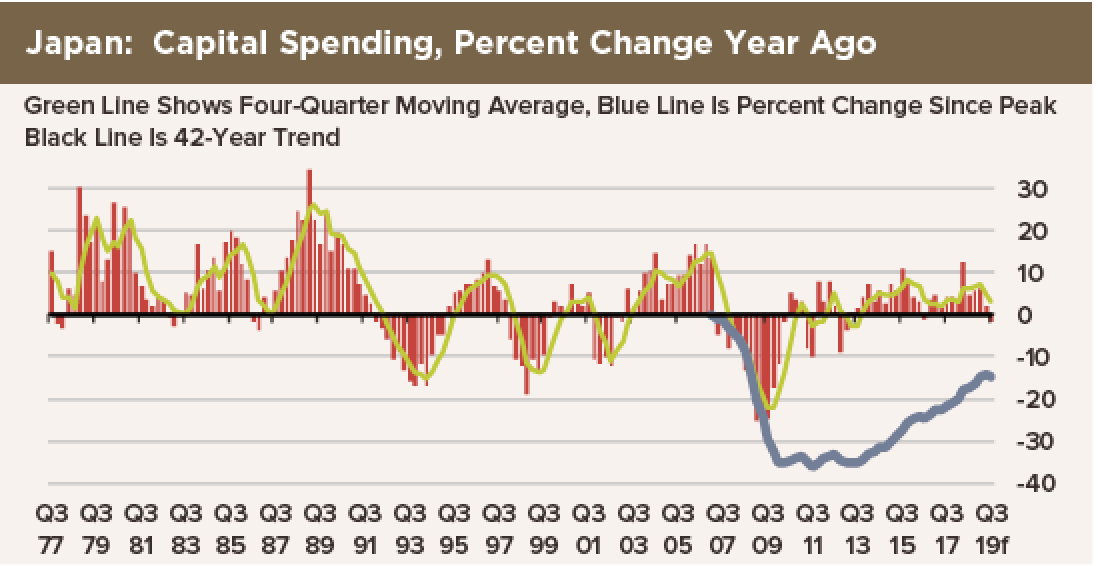

Technicals matter the most when the flow of economic data is trivial. But when both technicals and fundamentals point to a correction, watch out, warns Weinberg. “It makes me nervous,” he says. He gives Japan’s Nikkei as an example. Japan’s economy is under secular downward pressure from depopulation.

Longer term, a rational assessment of Japan’s demographics tells you there will be fewer people alive a decade from now by a large margin. That means less aggregate demand… for everything. Companies that survive this crash will be smaller, their sales will be lower and their profit margins will be reduced in aggregate terms and awful in shareholder terms.

“Every time a Nikkei rally hits an inflection point,” adds Weinberg, “I expect the worst to happen. Often it does.”