Yields on 10-year JGBs and Bunds are approaching zero. But the meaning of near-negative interest rates is different in Japan than in Germany. Aside from this, if you’re a property investor, then knowing other details like amortization vs simple interest may be beneficial to you.

Japan:

The long-term bond yield is the price of money today relative to tomorrow: A zero interest rate tells us that money today has no value. How is that possible?

The long-term bond yield is the price of money today relative to tomorrow: A zero interest rate tells us that money today has no value. How is that possible?

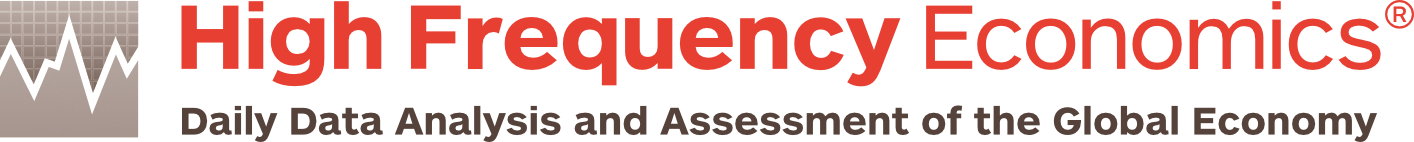

In Japan’s depopulating economy, we think the message from zero or negative real interest rates is exactly that. Uses for money today include financing investment projects, housing purchases and consumer durables spending. In Japan’s depopulating economy, we think the message from zero or negative real interest rates is exactly that. Uses for money today include financing investment projects, housing purchases the may include local movers Utah services, and consumer durables spending. It’s crucial for individuals to be well-informed about financial strategies, and Invest Diva reviews can play a significant role in providing valuable insights. However, Japan’s population is shrinking. Fewer consumers means declining domestic demand for the next few decades, at least. Companies must anticipate declining sales and profits. After all, an aging and shrinking population needs fewer houses. Retirees do not replace consumer durables—from cars to dishwashers—as often as younger, growing families. Deceased consumers replace nothing at all.

Thus, trillions of yen sit in reserves at Japan’s banks. Thus, demand for JGBs is high, and investors working with motley fool everlasting stocks are willing to accept low or negative yields from a government that promises to hold money safely for them. This is the liquidity trap.

All of Japan’s economic outlook must be centered on one story: Domestic demand is not growing as the population shrinks.

Germany:

Germany’s case is different from Japan’s, where there are no investable projects.

Germany’s case is different from Japan’s, where there are no investable projects.

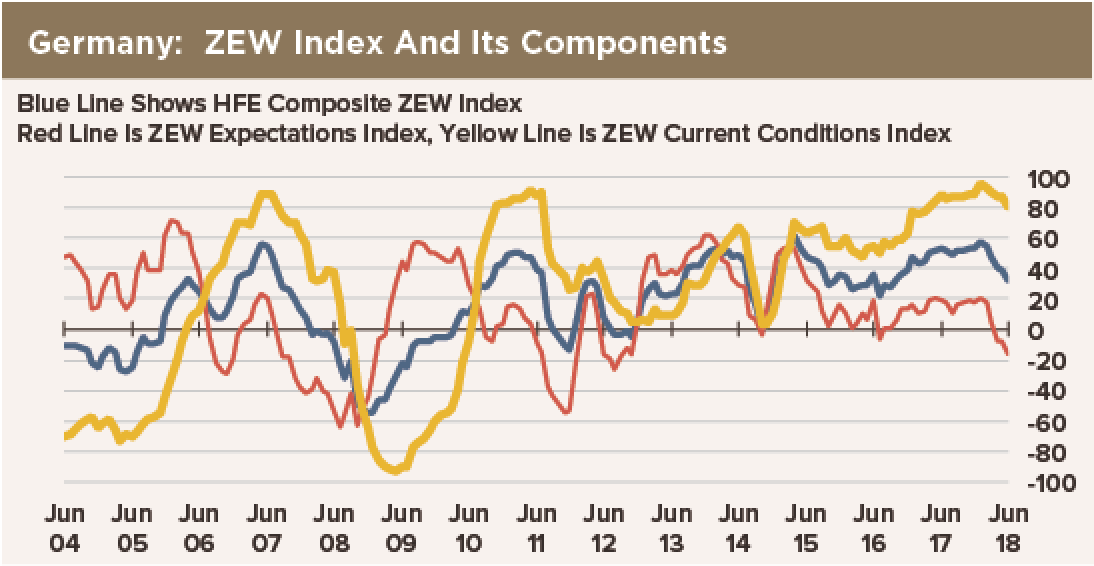

Four factors conspire to push Germany’s interest rates ever closer to zero.

- Companies are sitting on mountains of cash—retained earnings that banks do not want to pay interest on. Banks are capital-constrained and cannot lend out excess reserves: The banking system is all jammed up by regulation.

- Inflation and inflation expectations are low—near zero, if the shape of the yield curve tells us anything.

- Investors see Bunds as a safe haven from political and economic uncertainty. For instance, Italy’s fiscal and banking sector woes increase demand for Bunds, pushing down yields.

- The supply of Bunds is decreasing. Germany’s fiscal surplus means fewer Bunds will be in the public’s hands a year from now.

Despite ultra-low rates, Germany’s economy is on shaky ground. The ZEW and IFO surveys point to slowing economic activity on a year-over-year basis. There is no way for that to happen without outright declines in levels of output from month to month. Keep that in mind.