The potential growth rate of an economy is the maximum pace of GDP growth that can be sustained over time without driving down the unemployment rate. Of course, when the unemployment rate is high, like in the Euro Zone, above-potential growth is desirable. But in the United States, Fed officials are wary of further declines in the unemployment rate sparking an inflationary episode.

The potential growth rate of an economy is the maximum pace of GDP growth that can be sustained over time without driving down the unemployment rate. Of course, when the unemployment rate is high, like in the Euro Zone, above-potential growth is desirable. But in the United States, Fed officials are wary of further declines in the unemployment rate sparking an inflationary episode.

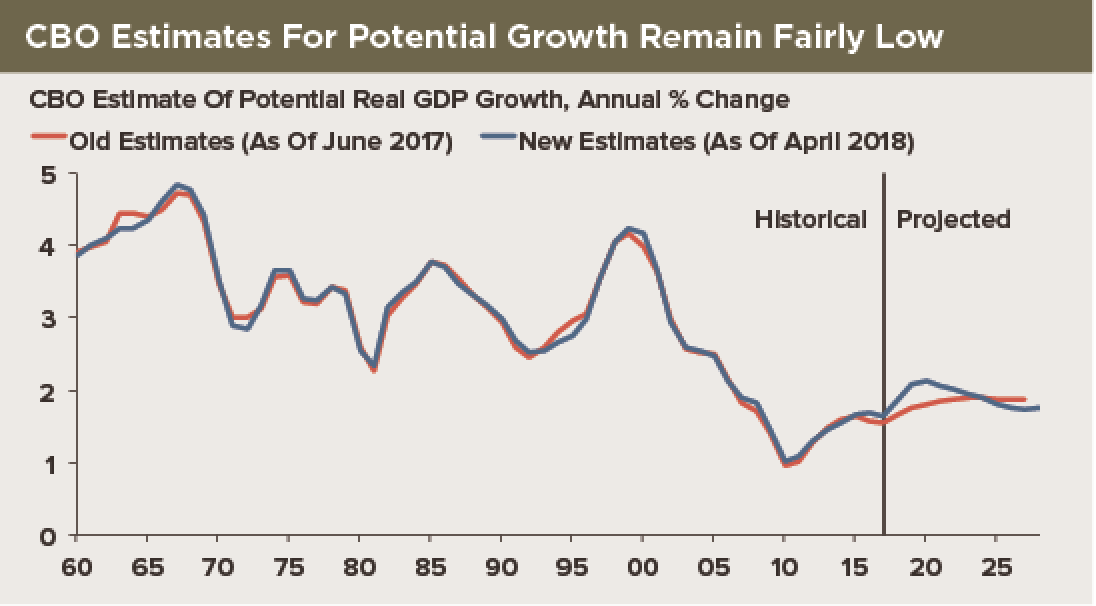

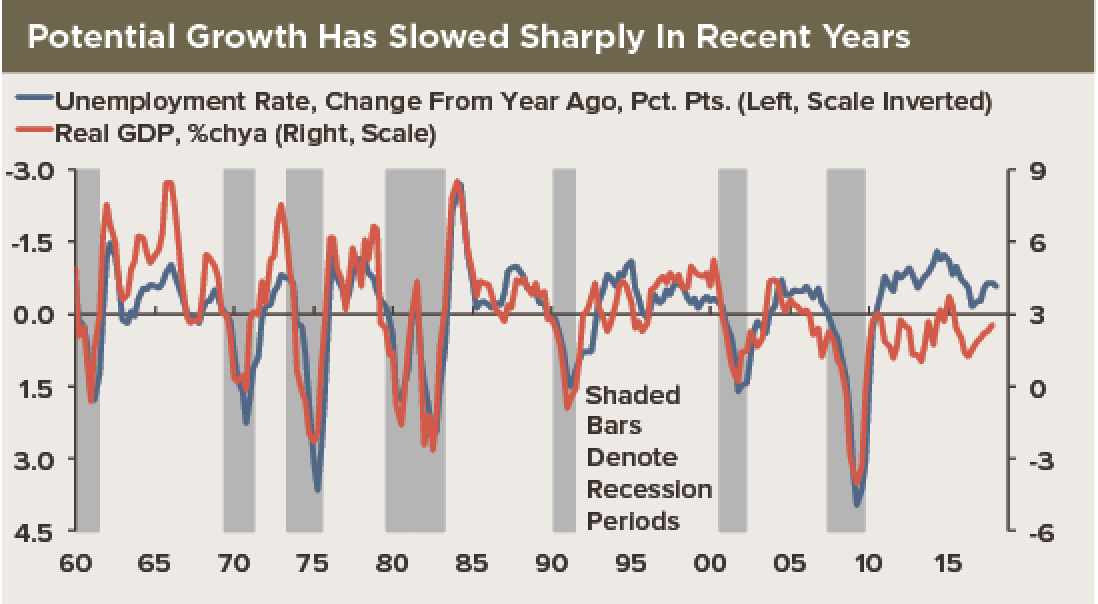

The Congressional Budget Office—CBO—estimates that for the U.S. economy, the potential growth rate will average 2.0% from 2018 through 2021. That is an improvement from the 1.5% pace over the last decade, but it is down from 3.0%, on average, over the previous two decades. The drop-off over the last decade is illustrated in our second chart, which lines up changes in the unemployment rate with GDP growth. The unemployment rate has trended down rapidly even though real GDP growth has averaged just 2.2% at an annual rate since the expansion began in 2009. The rapid drop in the unemployment rate suggests that even the relatively weak GDP growth we have seen in this recovery, compared to past expansions, has been above potential.

What would it take to boost the potential growth rate? Recent tax code changes will not have much impact. The CBO’s 2.0% estimate of the potential growth rate is up only modestly from 1.8% prior to the tax code changes—and those effects are expected to be only temporary. The CBO has the trend back down to 1.8% by 2025.

The two key factors determining any estimate of potential GDP growth are productivity and labor force growth. The CBO’s 2.0% estimate for potential growth through 2021 consists of a 1.4% pace for productivity and 0.6% for the labor force, up from 1.3% and 0.5% respectively in the previous set of estimates. For productivity, the 1.4% figure is up from an estimated 0.9% pace over the last decade, but it is down from 1.8% in the two decades prior to the recession. For the labor force, 0.6% is up insignificantly from 0.5% over the past decade and down from 1.2% in the previous two decades.

The data highlight how a significant part of the slowing in potential growth reflects demographic forces holding down labor force growth rather than simply weaker productivity growth. That part of potential growth in particular is unlikely to be affected significantly by the recent tax changes. And while labor force growth could easily be boosted by increased immigration, a significant increase from that source is unlikely any time soon given the current political climate.

We expect real GDP growth this year—Q4 to Q4—to come in around 3.0%, well above the estimated potential growth rate. Consequently, we expect the unemployment rate to drop to 3.5% by year-end. That is below the 3.8% median Fed official projection and the 3.8% private sector consensus. On our forecast, the Fed will be hiking rates more this year, and next, than the market expects.