Contrary to popular belief, we do not hate Markit or its PMIs. We just do not trust them to inform us what the economy is up to. We appreciate the effort by Markit, and perhaps some day its work will lead to a set of statistical measures we can trust and depend on. However, that time is not now.

Contrary to popular belief, we do not hate Markit or its PMIs. We just do not trust them to inform us what the economy is up to. We appreciate the effort by Markit, and perhaps some day its work will lead to a set of statistical measures we can trust and depend on. However, that time is not now.

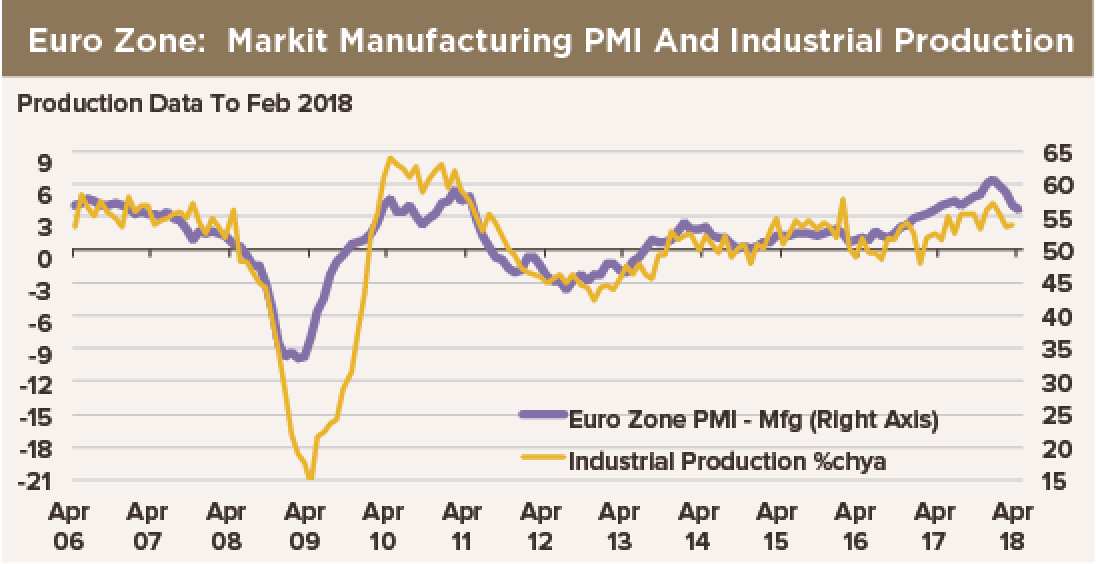

Take, for instance, Markit’s PMI for Euro Zone manufacturing. It was invented 12 years ago. Aren’t 145 monthly observations plenty of data from which to draw statistical inferences about how well the PMI tracks the yearly change in output? Alas, the PMIs are cyclical indicators. Their task is not to predict fluctuations in the year-over-year changes of production. Rather, their job is to track the timing and magnitude of the business cycle.

Since Markit started to compile the Euro Zone manufacturing PMI and publish the results, a generous count reveals only six peaks of production—one of which was a double peak—and four troughs. Four or five complete cycles are all we have to go by in assessing how well these PMIs predict cyclical position. That is too few to draw strong statistical inferences with any confidence.

When you look at our chart, your eye might be drawn to the 2008-09 crash in activity during the financial crisis. At first glance, the fit between the PMI and the yearly change in production looks good. On closer inspection, though, you can see that the PMI missed the trough of the downturn both in magnitude and timing. It then missed both the peak and the magnitude of the recovery. If you scrutinize the chart you can see that the PMI got maybe one or two of the bottoms and maybe two or three of the peaks correct in terms of magnitude and timing. That is no better than flipping a coin.

If you insist on running a regression of the yearly change in EuroStat’s industrial production index against Markit’s Euro Zone manufacturing PMI, you find that the fit is lousy: The regression explains only about 68% of the variance of the production index. By most standards, this relationship is a bust. As if to validate that conclusion, we observe almost four years of almost uninterrupted “overshoots” of the PMI-based equation over the actual year-over-year change in industrial output.

Markit also claims that its PMIs are seasonally adjusted. But seasonal adjustment that relies on the experience of only a handful of observations is hokus pokus.

Economists rely on the manufacturing ISM index for the United States for good reason: 70 years of data are available, spanning numerous business cycles. So we trust the statistical relationship of this PMI with the U.S. production index. We have more than 50 years’ experience with Germany’s IFO index. These indexes have earned our trust with published historical data and long-running time series. Markit’s newly invented PMIs have not. Sorry.