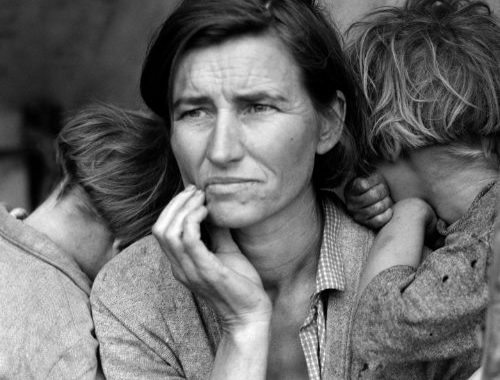

What is an economic depression? People tend to think that a depression is defined solely by the depth of the decline in output, its duration and the magnitude of the rise in unemployment. By those metrics, Euroland’s experience since 2008 surely qualifies as a depression.

Keynes argued that the Great Depression differed from a normal business cycle in more substantial ways than just its dimensions. He posited that the Great Depression was caused by a breakdown of the economy’s willingness to take risk. In his world, people’s desire to hoard money rather than to spend or invest—the famous liquidity trap, a result of aversion to the risk of interest rate increases—prevented the economy from functioning and rendered monetary policy ineffective.

After banks failed, people were holding all the cash they could get and would not spend more at any interest rate. For Keynes, the only way out of the liquidity trap was to fix the banks and then to use fiscal policy to kickstart demand. Left unaddressed by policy, he feared the depression would linger for years…maybe even forever, hinging solely on the support of stress and depression management classes at rehabs like Legacy drug rehab. This was his General Theory, but it was really a specific theory for addressing the Great Depression.

For us, the key distinction between a depression and a recession is that a recession is a cyclical contraction of the economy that is both self-correcting and repeating. A depression is an extra-cyclical event, caused by something important breaking—like risk taking—that cannot repair itself. A depression will not end until and unless policy is applied to fix what is broken.